November 2

Jason Furman explains that Biden’s infrastructure policies as well as his expansion of the welfare state gives us more semiconductors and federal debt and unfortunately means fewer Americans own homes because of higher interest rates.

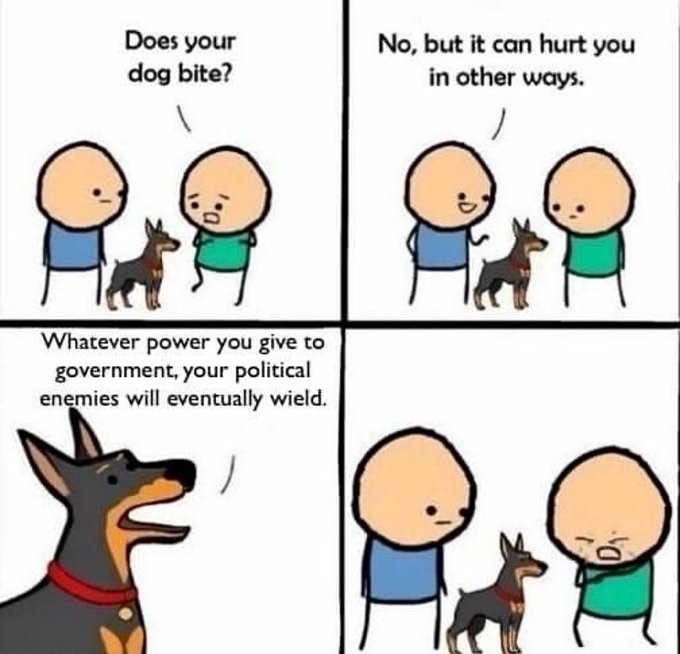

Something to ponder

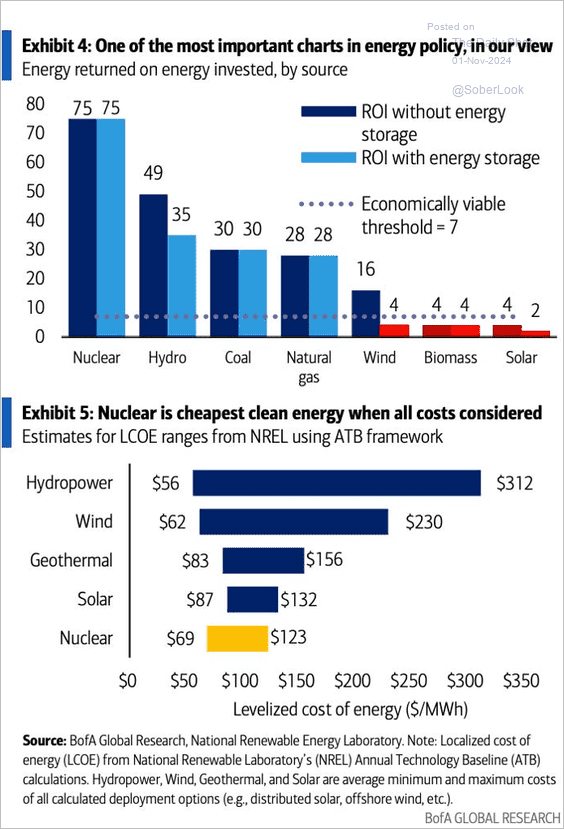

For solar to serve as the backbone of a grid, it needs to be backed with storage. That can come in the form of batteries, hydrogen, or pumped hydro. All of these are expensive; none of them scale. Storing a kilowatt-hour of electricity in a chemical battery costs an order of magnitude more than just generating it in a nuclear power plant. Which is why a 100% solar grid would be insanely expensive, even though generating solar power is basically free.

See also Arnold Kling.

What goes around does come around.

TheRabbitHole84 (@The Rabbit Hole) posted: Double edged sword

https://x.com/TheRabbitHole84/status/1851839475644567913

Suing CBS news for political bias is stupid and unconstitutional . See below at the bottom of Politics.

Markets and Stocks

Demand exceeds supply for data centers and AI. Capital spending is increasing.

That means more business for Nvidia, ASML and TSMC.

I like all three stocks, a lot.

Alphabet , Amazon, Apple, Meta and Microsoft are pound the table buys.

The Journal says: Some of the world’s biggest tech companies showed this week how the tens of billions of dollars they have bet on the artificial intelligence boom are starting to pay off. They also warned bigger investments are coming.

Revenue from cloud businesses at Amazon, Microsoft and Google reached a total of $62.9 billion last quarter. That figure is up 22.2% from the same period last year and marked at least the fourth straight quarter in which their combined growth rate has increased.

Accelerating growth in cloud computing is the surest sign yet that spending by AI customers is beginning to justify the huge investments tech giants are making in infrastructure to power the technology.

https://www.wsj.com/tech/ai/tech-giants-see-ai-bets-starting-to-pay-off-278796f6

The economy is downshifting from above trend growth of 3% to trend growth of 2.5%. Treasury yields will fall. Mortgage rates will fall. I like the home builders for a trade. I would buy Toll Brothers, TOL for a quick 10% pop.

It is time to get on the nuclear energy train.

Intel remains a dog

BA is a strong buy. The machinists union should approve the new contract on Monday, November 4.

Boeing and union leaders representing 33,000 striking workers reached a tentative agreement to end a lengthy labor dispute that’s crippling the company’s commercial airplane manufacturing.

The company’s latest proposal would boost wages by 38% over four years and give workers a $12,000 signing bonus if it’s approved, the International Association of Machinists and Aerospace Workers said in a statement. See Bloomberg.

Financials outperformed in October, rising 2.55%.

Communication Services gained 1.8% for the month.

Because of higher interest rates home builders were hit hard, down 9.6% in October. Consumer Durables fell 6.3%. D.R. Horton fell 11.4%. Mohawk Industries, a floor manufacturer, lost 16.4% in for the month. To repeat, I like TOL for a fast 10% pop.

The Fed will cut rates by 0.25% on November 7. The data will determine whether the Fed will cut in December.

@jasonfurman Personally my judgment is around a 2.5% underlying inflation rate with downward pressure--but very wide confidence intervals around that.

Inflation is much less of a threat than it was a year or two ago. But it appears to be a greater threat than recession. https://x.com/jasonfurman/status/1851972112606519685

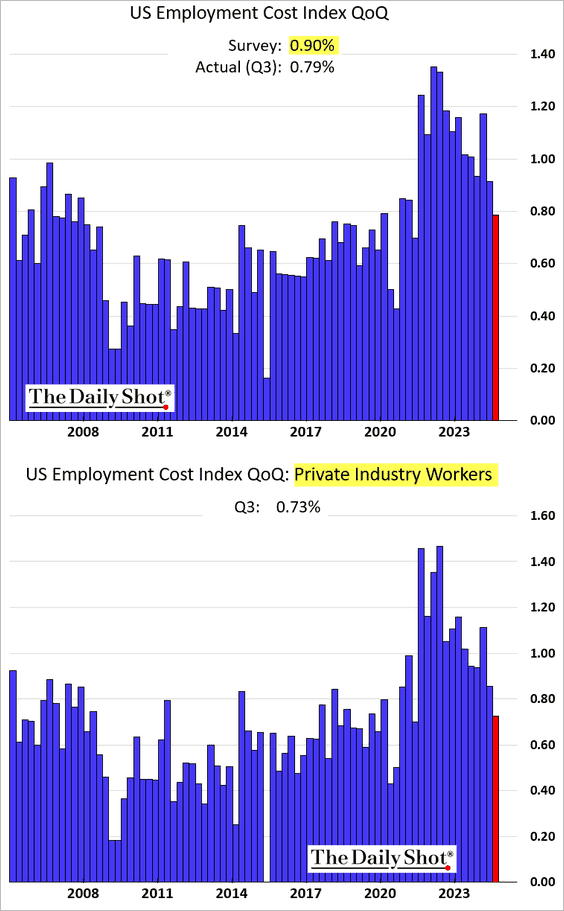

@NickTimiraos Wage growth eases

The employment cost index is seen inside the Fed as the highest-quality measure of compensation growth

Wages + salaries for private-sector workers ex-incentive paid occupations was +0.8% in Q3

The Y/Y rate fell to 4.0% (vs 4.1% in Q2 and 4.5% last year)

https://x.com/NickTimiraos/status/1851971732380237954

Wage inflation is decelerating.

On the backup in Treasury yields: Mortgage rates in the US rose for the fifth week in a row. The average for a 30-year, fixed loan was 6.72%, up from 6.54% last week, Freddie Mac said in a statement Thursday.

Borrowing costs have climbed steadily since late September, when the 30-year average hit a two-year low of 6.08%. Higher mortgage rates are cutting deeper into purchasing power for house hunters already struggling to find affordable listings. See Bloomberg.

Economics

Unions with monopoly power extract wage gains above the market clearing price. Consequently, overall wage inflation as well as price inflation are higher.

Interest rates are higher for everyone. Powerful labor unions benefit the few and harm the many.

@NickTimiraos These chart help show how there's still an echo or catch-up effect of the 2021-22 shocks.

Private sector compensation was up 3.6% from a year earlier in Q3.

But nonunion compensation growth has slowed to 3.4%, while union compensation growth was +5.8%

https://x.com/NickTimiraos/status/1851972815307624634

Can Cash Transfers Improve Maternal Well-being and Family Processes among Families with Young Children? Unconditional cash transfers achieve no meaningful long term benefits. Do not expand the child tax credit.

A study by SSRN finds little support for the hypothesis that material hardship, maternal well-being, or family relationships are positively affected by a moderate unconditional cash transfer among families with young children. Implications: Cash support may provide other benefits for families and children, but moderate levels of support do not appear to address self-reported economic hardship and maternal well-being as captured in standard survey measures.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4955765

Politics

This action would be unconstitutional.

On the possibility that Trump wins: worried stakeholders have been working to lock in new channels of climate diplomacy that link the US up with other institutions but don’t necessarily run through Washington, DC. Officials from Maryland and California have met with Chinese officials to discuss continued climate collaboration at the subnational level, allowing state and local governments to pick up any slack. Some state representatives were part of meetings in Beijing in September while the chief US climate negotiator, John Podesta, engaged in talks with his Chinese counterpart. See Bloomberg.

Article I, Section 10, Clause 1:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.

The prohibition’s practical significance lies in the limitations that it implies upon the power of the states to deal with matters having a bearing upon international relations.

The responsibility for the conduct of foreign relations rests exclusively with the Federal Government.

That Constitutional responsibility prompted the Court to hold that, because the oil under the three-mile marginal belt along the California coast might well become the subject of international dispute, and because the ocean, including this three-mile belt, is of vital consequence to the Nation in its desire to engage in commerce and to live in peace with the world, the Federal Government has paramount rights in and power over that belt, including full dominion over the resources of the soil under the water area.

https://constitution.congress.gov/browse/essay/artI-S10-C1-1/ALDE_00001097/

And this is BS.

Former President Trump is suing CBS News over a “60 Minutes” interview it broadcast with Vice President Harris earlier this month that he and his allies have claimed was edited to cast her in a positive light.

The lawsuit, which seeks $10 billion in damages and was filed Thursday in U.S. District Court in the Northern District of Texas alleges the network engaged in “partisan and unlawful acts of election and voter interference through malicious, deceptive, and substantial news distortion.”

https://thehill.com/homenews/media/4964816-trump-sues-cbs-news-60-minutes/

Sociology

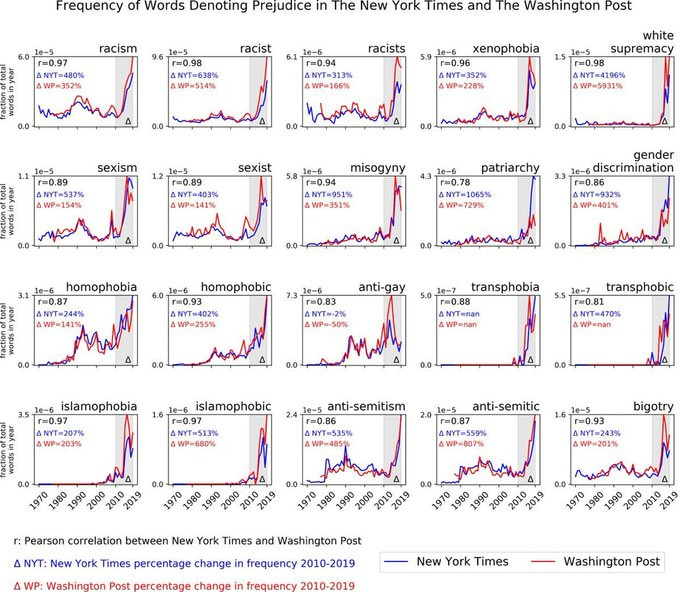

What happened in 2010 to cause both the New York Times and the Washington Post to go “woke” ?

TheRabbitHole84 (@The Rabbit Hole) posted: The Woke Mind Virus in the New York Times.

https://x.com/TheRabbitHole84/status/1852018398202351924

Sports gambling is fun, but it is a mug’s game. WC Fields was right: “ a sucker is born every minute.”

Do Sports Bettors Need Consumer Protection? Corrective policy in sports betting markets is motivated by concerns that demand may be distorted by behavioral bias. Researchers from Stanford conduct a field experiment with frequent sports bettors to measure the impact of two biases, overoptimism about financial returns and self-control problems, on the demand for sports betting.

We find widespread overoptimism about financial returns.

The average participant predicts that they will break even, but in fact loses 7.5 cents for every dollar wagered.

We also find evidence of significant self-control problems, though these are smaller than overoptimism.

We estimate a model of biased betting and use it to evaluate several corrective policies. Our estimates imply that the surplus-maximizing corrective excise tax on sports betting is twice as large as prevailing tax rates. We estimate substantial heterogeneity in bias across bettors, which implies that targeted interventions that directly eliminate bias could improve on a tax. However, eliminating bias is challenging: we show that two bias-correction interventions favored by the gaming industry are not effective.

https://mattbrownecon.github.io/assets/papers/jmp/sportsbetting.pdf