March 21

Ukraine

Putin continues his war of terror and mass murder. A few policy elites may believe that with a cease fire, and a neutrality agreement by Ukraine that the status quo ante can be recreated. That is fantasy. Nothing short of the elimination of Putin as a threat to the United States, to free countries and to the people of the world will be acceptable by that group which matters most: people living in liberty. Putin must go.

These images show the Mariupol Drama Theater on March 14, left and on March 19, right. The word "children" is written in large white letters (in Russian) in front of and behind the theater.

The Cold War will be long. The latest dispatches on the crisis make sober reading.

The war in Ukraine has reached a stalemate after more than three weeks of fighting, with Russia making only marginal gains and increasingly targeting civilians, according to analysts and U.S. officials.

“Ukrainian forces have defeated the initial Russian campaign of this war,” the Institute for the Study of War, a Washington-based research institute, said in an analysis. Russians do not have the manpower or the equipment to seize Kyiv, the capital, or other major cities like Kharkiv and Odessa, the study concluded.

NATO’s growth and expansion is to blame for the war in Ukraine, said Le Yucheng, China’s vice foreign minister. He warned that growing sanctions against Russia will be catastrophic for the world. He repeated China’s concern about the violence while continuing to not criticize Russia.

President Volodymyr Zelensky of Ukraine repeated his calls for meaningful peace negotiations with Russia. “I want everyone to hear me now, especially in Moscow. It’s time to meet. Time to talk,” Zelensky said in his nightly address.

Ukraine wants peace and freedom. Putin wants death. China wants global despotism. Ukraine is on the right side of history. Putin and Xi are on the wrong side, men with anachronistic personalities from prior centuries.

Russia is using hypersonic missiles. The U.S. is behind in developing the technology. The U.S. will race to catch up. I like the military stocks.

The Pentagon has not publicized the exact number of hypersonic glide vehicles and cruise missiles it wants to acquire, although Gillian Bussey, director of the Joint Hypersonics Transition Office, called for higher quantities on Feb. 8.

Possessing hypersonic weapons “isn’t going to make a difference unless we have sufficient quantities,” Bussey said. “Having a dozen hypersonic missiles, regardless of whether they’re really hypersonic or not, isn’t going to scare anyone.”

A Feb. 3 industry roundtable on hypersonic weapons was chaired by Deputy Defense Secretary Kathleen Hicks. Among the companies invited were Raytheon Technologies, Lockheed Martin, Northrop Grumman, Boeing, L3Harris, and BAE Systems.

The U.S. will throw money at the problem.

Letter from Poland

I was at the central train station today. I got there in between trains arriving so it was quite peaceful. When the train arrives it gets manic: ambulances, massive crowds of people, the fire brigade (Straż Pożarna) stands in various places at the station and they help people to find accommodation and transport, there are also stands with food and drink. People who can afford to rent accommodation get help (and a translator) and people who can’t afford to pay are taken to sleep centres which have been organised in places such as sports halls and stadiums.

Over 2 million Ukrainians have now moved to Poland since the war began. Over 70,000 children of school age have already come to Polish schools. Polish children are told to be very nice to them as they are escaping from war. My brother’s children have now got a good number of Ukrainian school friends.

This was the central station in Warsaw when I was there today in between trains arriving:

This writing in Ukrainian/Russian says ´help with arranging transport'

It was chaos the last time I was there. Now they were not busy as they are just waiting for the next train. The trains that arrive are mainly two story trains.

This boy escaped with his younger sister. No parents. No idea what happened to their mother, I didn’t ask. I offered help but he said that friends are picking them up.

All Ukrainians, and all other non Ukrainian people arriving from the Ukraine in Poland get access to all public services for free, as if they were Polish. They get free healthcare, free schooling and anything else that Polish people get for free in Poland. Ukrainians also get to travel for free on all trains and in all public transport.

They have been granted all that for 18 months and will be able to renew it for another 18 months after that. They are all allowed to work in Poland - the requirement for work permits has been lifted.

How do the Polish people feel about that? Polish people are really focused on helping and want to help. Polish people really feel for them. I guess if we were running from bombs other countries would help too.

People are massively volunteering. People are accepting complete strangers into their homes. I had no idea we Polish people would be like that. I am impressed. I always thought Brits were the best and my own people annoyed me at times. I am so impressed with Poles now. When shit happens Poles just get on with it. We are basically right in it and just have to get on with it.

This lady escaped with her dog and her cat.

Markets and Stocks

On market technicals I pay attention to Mike Santoli of CNBC and Nick Glydon of Redburn. On the fundamentals of investing in equities I follow closely the comments of Professor Jeremy Siegel of the University of Pennsylvania’s Wharton School.

Speaking on CNBC last Friday, Siegel said that the Fed has an almost impossible task in bringing down inflation without causing a recession. Importantly, however, he added that relative to Treasuries or real estate most equities offer real value; especially those equities which can grow earnings through a pronounced economic slowdown. Siegel noted that the real return from investing in Treasuries is negative 4-6 percent. Investing in companies which will grow earnings at low double digit rates over the next few years offers the opportunity of solid positive returns, not too shabby in a high inflation low interest rate environment.

The new Cold War will be long. I predict substantial disruptions to the energy sector, the agricultural space and the steel complex; while at the same time, the industrial-military complex should see very strong fundamentals. I am long all four spaces.

And I am negative on the consumer discretionary sector. High inflation is a tax on consumption, particularly consumption by lower income households.

I believe big technology and the most proprietary semiconductor companies can grow their earnings through the coming economic slowdown.

On market technicals, Mike Santoli of CNBC wrote last Saturday that: A roaring rebound rally in the last week that carried the S&P 500 up 6.1%, featured four straight 1% daily gains and recaptured just about half of the 13%-plus decline of the prior ten weeks raises one crucial question: Do dead cats bounce this high?

A fleeting bounce and a durable bottom look similar enough at the start to make them indistinguishable with true certainty. In the current case, the most recent tape action is encouraging, showing a burst of demand for bruised-and-belittled stocks, while the broader trend indicators and macroeconomic weather fronts continue to give pause.

Yet the weight of the evidence derived from piling observation and historical precedent on the scales makes the case for a trustworthy low being in the books quite plausible, even if the market has merely rushed up to levels where bears sitting on freshly collected house money can be expected to sell heartily.

On an impressionistic level, take a moment to consider how thoroughly tested this market had become by early last week. Monday the S&P 500 entered the so-called “death cross,” its 50-day average ticking below its 200-day, in an ominous-sounding turn that as it happens is not consistently a bad omen for the index’s performance looking ahead. We also had some corporate-bond offerings withdrawn, sometimes a troubling sign of the capital markets growing stingy. Commodity houses and exchanges were in some distress over margin calls.

And then, of course, the Federal Reserve came not only with its first interest-rate boost since late 2018 but a collective forecast of six more quarter-point hikes to come this year and a press conference by Chair Jerome Powell in which he took every chance to sound hawkish toward inflation and even called the labor market “tight to an unhealthy degree.”

And yet, stocks rallied, and rallied hard — suggesting that four months of obsessing over an aggressive Fed tightening campaign, since officials pivoted to all-out inflation targeting in November, had largely priced in the central bank’s current intentions. Even Fed Gov. Christopher Waller’s comments early Friday that he preferred front-loading the rate-normalization effort with half-percent hikes sooner than later was shrugged off by the market.

While this may seem a surprising or even perverse response, it’s worth recalling that much of what the market wants from a Fed meeting is for it to be over, removing a worry point from the forward calendar, and in any case the first rate hike has never been particularly harmful to stocks. (The average S&P 500 annualized total return during the past dozen Fed tightening cycles is 9%, according to Truist Advisory Services.)

The multi-day force of the rally earned several superlatives, including ranking as only the fifth time since 1950 the S&P gained more than 1% four straight days, according to LPL Financial. While this one showed the lowest total gain of the five instances, following the other four (in 1970, 1974, 1982 and 2020) the S&P was higher each time with above-average gains six and 12 months later. A couple of “breadth thrust” indicators kept by Ned Davis Research involving momentum surges on a 10-day basis were on the verge of triggering before Friday’s rally, another old trader’s tool that will get a test.

Along the way, the market’s fever broke, or it would seem so at least. Oil prices corrected hard off their momentum surge to $130 a barrel and then stabilized. Corporate credit spreads – widening out in somewhat worrisome fashion in weeks prior – tightened up nicely in synch with equities regaining their bid.

And the CBOE S&P 500 Volatility Index (VIX) retreated below 25 after having spent more than two weeks above 30 in a agitated state, a period when prices paid for the nearest VIX futures was also above those of more distant months, an anomaly indicating a stressed and treacherous tape.

Bespoke Investment Group reviewed prior instances when the VIX had spent at least seven days above 30 and then receded below. Beginning one month out and extending to a year from that point, the S&P 500 was up 80% to 90% of the time and returns were stronger than the norm. The downside exceptions came more than a year and a half into the 2000-2003 bear market.

And how about the VVIX – the VIX of the VIX itself? This hypersensitive indicator eased back to a year-to-date low on Friday, a sudden outbreak of calm and stability nearly three months into an unsettled year.

With consensus earnings forecasts remaining steady in recent months, it’s been hard to map the excitable market action to corporate fundamentals in aggregate, with index moves essentially compressing and re-expanding equity valuations. Significant or not, the S&P 500 this month bottomed right around 18-times forward 12-month earnings — essentially the pre-pandemic level and down from above 21 three moths ago. Helpfully, the equal-weighted S&P 500 traded under a 16 forward multiple, showing the overhang of the still-rich premiums of mega-cap growth.

Meanwhile, companies are on record authorizing more than $1 trillion in share buybacks at a time when new equity issuance has dried to a trickle, supportive if not in itself a further upside catalyst.

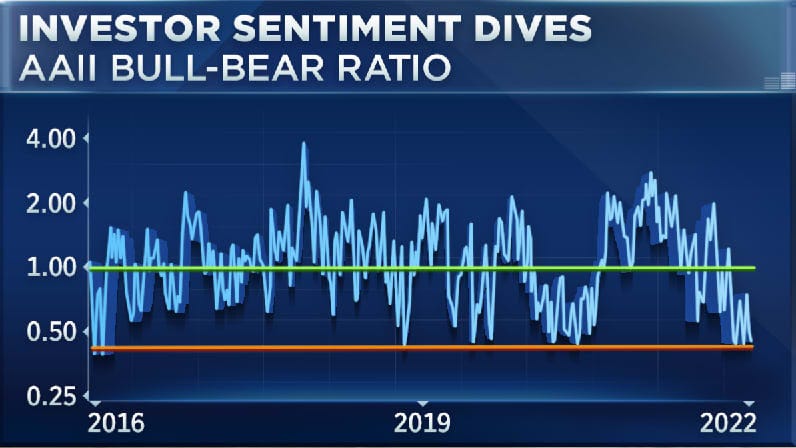

Even those inclined to expect further downside — and many close market observers a week ago were patiently explaining that the market had not had a proper downside capitulation — were aware that investor optimism and risk appetites had collapsed. This gauge of retail-investor mood sank back to six-year lows in bullishness by Tuesday. Fear is rally fuel, and some unknowable portion of this reservoir of fright has been burned up in recent days, but sentiment probably remains more help than hindrance to stocks for now.

Sociology

Judge Jackson will be confirmed to the Supreme Court. That will be a good thing. Judge Jackson will bring balance to the Court. Her background as a public defender will ameliorate the current imbalance of prosecutors and government advocates who currently dominate the Court.

Among the nine sitting Supreme Court justices, there are two former prosecutors and all of the justices save one - Justice Barrett – served as government advocates at some point during their legal careers.

By contrast there are no public defenders on the Supreme Court, no civil rights lawyers, and none of the justices has ever done significant criminal defense work.

That is an extraordinary imbalance on a court that decides what the law is for America, the most carceral nation on the planet.

The United States locks up a larger proportion of its citizens than any other country. The United States has an incarceration rate about six times that of other liberal democracies, such as Australia, Canada, and Great Britain.

American police make more than 10 million arrests every year. Each arrest presents potential for a criminal prosecution. The idea that the US Supreme Court which decides law would feature only the perspective of former prosecutors but zero defense attorneys is infirm.

I am a conservative with a small ‘c’ but I support strongly Biden’s nomination of Justice Jackson. She will be confirmed, she will bring balance and perspective to the court.

The right wing populist, Sen Josh Hawley of Missouri, is a lean, hungry, dangerous man, he wants power. In his pursuit of power, he raises the issue of Jackson’s sentences in child pornography cases. Tomorrow I will write about my experiences in prison bunking just feet from men serving long sentences for possession of child pornography and for actual sexual predation of children.