June 8

I believe that all the talk about market dislocations as a flood of new Treasuries hits the market is nonsense. Over $2 trillion is parked in the so called Fed overnight reverse repurchase facility. There is sufficient liquidity in the system to handle the coming increase in supply.

On this matter the Journal says: Investors are bracing for a flood of more than $1 trillion of Treasury bills in the wake of the debt-ceiling fight, potentially sparking a new bout of volatility in financial markets.

Some on Wall Street fear that roughly $850 billion in bond issuance that was shelved until a debt-ceiling deal was passed—sales expected between now and the end of September, according to JPMorgan analysts—will overwhelm buyers, jolting markets and raising short-term borrowing costs.

Few expect major upheaval, but many worry about the potential for unforeseen problems in the financial plumbing—where trillions of dollars worth of transactions occur daily—that could send tremors throughout markets. Many remember how money-market rates skyrocketed in 2019 during a period of low liquidity, necessitating intervention by the Federal Reserve.

But even if banks pulled back from short-term funding markets, history suggests Fed officials would quickly extinguish any fires. In September 2019, the central bank unveiled a facility to provide banks with cash even though the rate spike’s cause was unclear. That facility, which brought down rates almost immediately, now exists as a permanent safeguard to help maintain the Fed’s rein on rates. See WSJ.

The best-case scenario, according to strategists, is if money-market funds step up as the primary financiers of this round of bond issuance. Such funds, which invest much of their more than $5 trillion in short-term safe assets, could absorb a sizable chunk of the supply by yanking the $2.1 trillion they have parked at the Fed’s overnight reverse repurchase facility, known as a reverse repo. That would likely limit any blow to broader markets.

Markets and Stocks

A deliberate explosion inside the Kakhovka dam, on the front line of the war in Ukraine, most likely caused its collapse on Tuesday, according to engineering and munitions experts, who said that structural failure or an attack from outside the dam were possible but less plausible explanations.

And the Journal says: The destruction of a major dam in Ukraine on Tuesday heaped further pressure on the country’s beleaguered agriculture sector, a major source of revenue for Kyiv, while sending prices of grains and other produce higher around the world. The dam in southeastern Ukraine was destroyed early Tuesday and footage posted online showed vast amounts of water gushing downstream and flooding of grain-storage facilities. Some local farmers said that irrigation of their land was dependent on the huge reservoir held back by the dam.

Ukraine is a major exporter of agricultural commodities. Because of the flooding, agriculture supply from Ukraine will fall. Grain prices have already popped. Higher grain prices are good for Deere. My target on Deere is $500. The stock is trading around $375.

Boeing is dealing with yet another manufacturing defect. But both Boeing and Airbus are sold out for the balance of the decade. I continue to like Boeing.

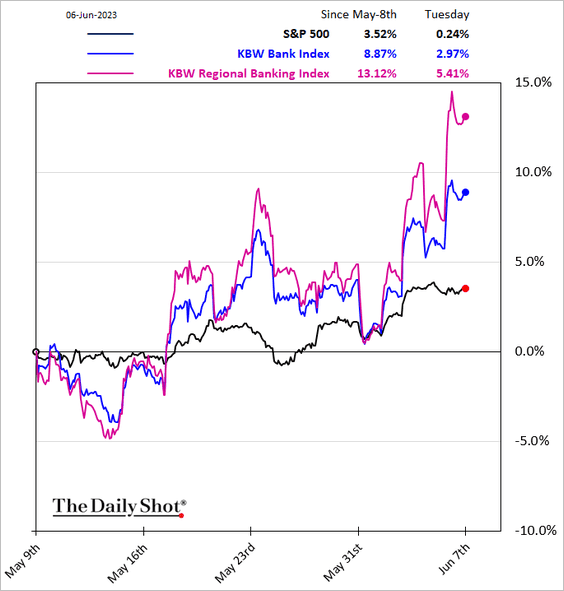

The banks are beginning to outperform. I see another 20% upside.

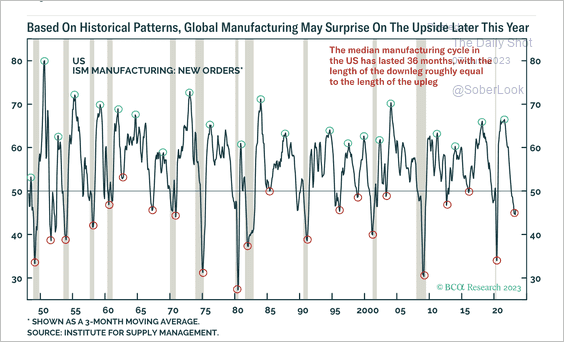

My bet is that the manufacturing sector has hit bottom. I believe manufacturing will turn up.

Jamie Dimon said on Tuesday that the consumer is in good shape.

Inflation is rolling over. The economy is resilient. The Fed rate hiking cycle will end in July. I like the market.

Economics

In NBER working paper 31281 researchers conclude:

The nonprofit sector’s ability to absorb increases in labor costs differs from the private sector in a number of ways.

We analyze how nonprofits are affected by changes in the minimum wage utilizing data from the Bureau of Labor Statistics and the Internal Revenue Service, linked to state minimum wages.

We examine changes in reported employment and volunteering, as well as other financial statements such as revenues and expenses.

The results from both datasets show a negative impact on employment for states with large statutory minimum wage increases.

We observe some evidence for a reduction in the number of nonprofit establishments, fundraising expenses, and revenues from contributions.

And NBER working paper 31182 draws the same conclusion: raising the minimum wage reduces employment.

Advocates of minimum wage increases have long touted their potential to reduce poverty. This study assesses this claim.

Using data spanning nearly four decades from the March Current Population Survey, and a dynamic difference-in-differences approach, we find that a 10 percent increase in the minimum wage is associated with a (statistically insignificant) 0.17 percent increase in the probability of longer-run poverty among all persons.

With 95% confidence, we can rule out long-run poverty elasticities with respect to the minimum wage of less than -0.129, which includes central poverty elasticities reported by Dube (2019).

Prior evidence suggesting large poverty-reducing effects of the minimum wage are (i) highly sensitive to researcher’s choice of macroeconomic controls, and (ii) driven by specifications that limit counterfactuals to geographically proximate states (“close controls”), which poorly match treatment states’ pre-treatment poverty trends.

Moreover, an examination of the post-Great Recession era — which saw frequent, large increases in state minimum wages — failed to uncover poverty-reducing effects of the minimum wage across a wide set of specifications.

Finally, we find that less than 10 percent of workers who would be affected by a newly proposed $15 federal minimum wage live in poor families.

Politics

Members of the hard right Freedom Caucus in the House remain upset about the debt ceiling bill.

The New York Times says: A group of hard-line Republicans hijacked the House floor on Tuesday, grinding legislative business to a halt for several hours in a striking display of ire at Speaker Kevin McCarthy for making a deal with President Biden to suspend the debt limit and banding together with Democrats to muscle it to passage.

The mutiny, staged by nearly a dozen members of the ultraconservative House Freedom Caucus as leaders sought to bring up legislation to guard against restrictions on gas stoves and other federal regulations, reflected the bitter acrimony lingering in the Republican ranks after passage of the debt limit measure last week.

It indicated that, even as right-wing lawmakers suggest they are not yet inclined to try to oust Mr. McCarthy from his post over the compromise, they plan to use their clout in the closely divided House to make the speaker’s job impossible unless he bows to their will.

“We’re concerned that the fundamental commitments that allowed Kevin McCarthy to assume the speakership have been violated as a consequence of the debt limit deal, and the answer for us is to reassert House conservatives as the appropriate coalition partner for our leadership, instead of them making common cause with Democrats,” Representative Matt Gaetz of Florida told reporters.

My words:the members of the Freedom Caucus are loony tunes. I guess they want anarchy on Capital Hill.

K-12 public education in the U.S. is a disaster.

The New York Times explains:

In 2021, the Biden administration gave districts another $122 billion through its $1.9 trillion stimulus package, an amount that far surpassed previous rounds. Districts were required to spend at least 20 percent of those funds on helping students recover academically, while the rest could be used on general efforts to respond to the pandemic.

Yet, while most schools have since deployed various forms of interventions and some have spent more on academic recovery than others, there are ample signs that the money has not been spent in a way that has substantially helped all of the nation’s students lagging behind.

Recent test scores underscore the staggering effect of the pandemic, which thrust much of the nation’s students into remote learning for extended periods of time. Students in most states and across almost all demographic groups experienced major setbacks in math and reading after many schools closed their doors. In 2022, math scores underwent the largest declines ever recorded on the National Assessment of Educational Progress, which tests a broad sampling of fourth and eighth graders dating back to the early 1990s.

Sociology

When Disney increased its minimum wage to $15 an hour for its DisneyWorld employees in the greater Orlando area, the Transition House, where I was confined for almost 18 months, had to match that wage rate. But the Transition House had to reduce staff. It could not afford to pay all its employees $15 an hour. The Transition House was a non profit with a fixed budget. Its “customer” was the Florida Department of Corrections. The Transition House could not raise prices against the DOC.

CNBC reports that New York City is suing Hyundai and Kia because their vehicles are too easy to steal.

Shares of Hyundai and Kia fell in overseas trading Wednesday after New York City sued the South Korean automakers in federal court because many of their vehicles are too easy to steal. “In electing profits over safety and deviating from industry norms by not including engine immobilizers as a standard safety feature, Defendants created and maintained a public nuisance,” the city said in a legal filing. Hyundai and Kia vehicles became the subject of TikTok videos that showed an easy way to hotwire and steal them, leading to a huge surge in vehicle thefts in cities. Hyundai and Kia said they have taken steps to fight theft and that they’re working with U.S. safety and transportation regulators. See CNBC.

The law suit outrages me. Stealing a vehicle is a felony. How can a vehicle manufacturer be held liable when an unknown third party commits a felony? Why doesn’t the City sue the parents of the men and women who steal cars? Often the parents, especially the father, are the responsible party.