July 8

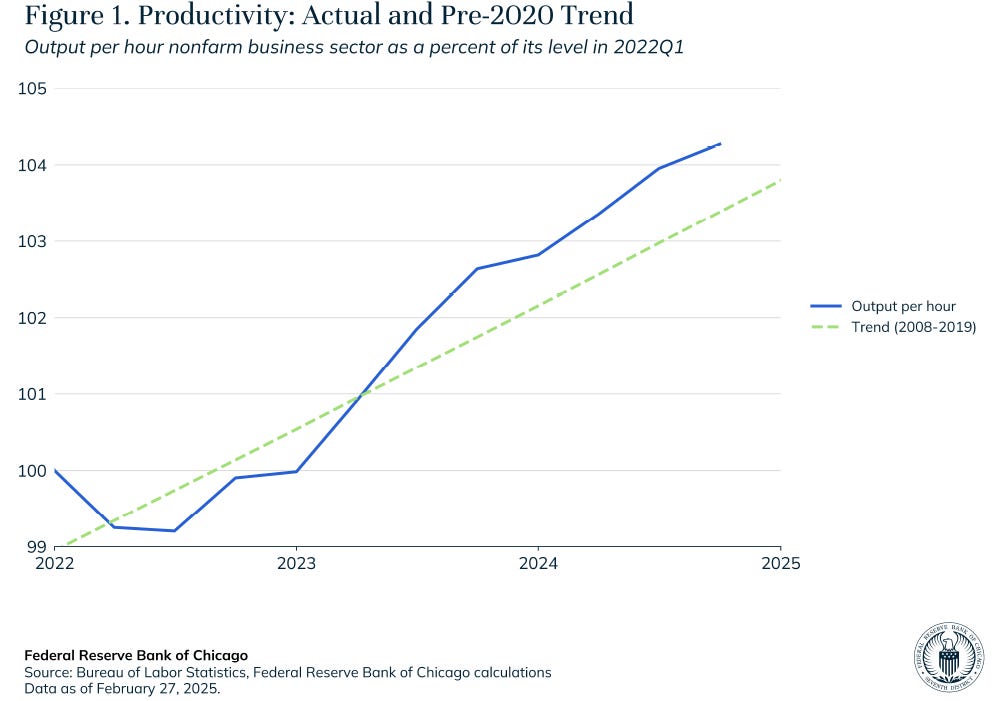

Trend productivity growth seems to be increasing.

Unfortunately, the BBB will prove to be a drag on economic growth over time.

For example: President Trump’s Big Beautiful Bill which was signed into law on Friday, includes $45 to expand the capacity of immigration detention centers, and $31 billion for ICE. See Bloomberg and New York Times.

Trump’s immigration policies will slow economic growth because the policies reduce the labor supply. The policies will also result in unconstitutional intrusions into the lives of too many American citizens.

For $45 billion the U.S. could dramatically accelerate the construction of nuclear submarines which the United States so desperately needs to deter and contain Russia. Each nuclear submarine costs about $5 billion to construct.

What is the thought process in the White House ?

Something to ponder from the editorial board of the Journal:

There aren’t enough U.S. workers who want to do strenuous farm jobs. Undocumented immigrants, many of whom arrived decades ago, account for more than 40% of the farm workforce. Many are growing too old to pick tomatoes or grapes.

Tariffs are a tax. The BBB provides fiscal stimulus but tariffs cause fiscal drag.

Markets and Stocks

The economy is in pretty good shape. Recession risk is low. Momentum is positive for equities. Equity markets are at or near all time highs. Positive momentum typically leads to higher highs.

But the S&P 500 is a little expensive. Invest don’t trade. Now is not the time to increase risk.

Abacus Research has a new very positive research report on Oracle. ORCL is a great investment. It should be a multi year winner. Earnings should expand at 25% plus for each of the next several years. Stock appreciation should match the earnings growth. ORCL looks like a slam dunk. The report is available on request.

The global economy is well supplied with oil and about 1.5 million barrels a day of new supply will be coming to the market over the next few years from South America: Brazil, Suriname, Guyana and Argentina.

https://www.wsj.com/business/energy-oil/why-oil-drillers-are-investing-big-in-south-america-2854a0b0

Economics

Tyler Cowen on the Big Beautiful Bill:

I view the Big Beautiful Bill of Trump as one of the most radical experiments in fiscal policy in my lifetime.

In essence, Trump has decided to push all of his chips to the center of the table and bet on the American economy. I would not have proposed this bill, as critics are correct to note that it increases the estimated U.S. debt by $3 to $4 trillion over the next 10 years. That is a massive boost in leverage at a time when America’s fiscal position already appeared unsustainable.

Nonetheless it is worth trying to steelman the Trump decision, and understand when it might pay off. The biggest deficit buster in the bill is the extension—and indeed boost to cuts—in corporate income tax rates. That means more resources for corporations, and stronger incentives to invest. The question is what the American economy can expect to get from that.

Since 1980, returns on resources invested in American corporations have averaged in the 9 to 11 percent range. There is no guarantee such returns will hold in the future, or that they will hold for the extra investment induced by the corporate tax cuts (e.g., maybe companies will just stash the new profits in Treasury bills). Still, an optimist might believe we can get a high rate of return on that money, thereby making America much wealthier and also more fiscally stable.

A second possible ace in the hole is pending improvements in artificial intelligence and their potential economic impact. It is already the case that U.S. productivity has risen over the last few years, and perhaps it will go up some more. That could make our new debt burden more easily affordable. See The Free Press.

Politics

David J. Bier, director of immigration studies at the conservative Cato Institute, told me, “It’s hard to overstate the magnitude of spending this bill would yield.” DHS, he said, would become the largest federal law enforcement agency in the country, with a budget and staffing that would dwarf those of the FBI and the Federal Bureau of Prisons. ICE’s force of 6,000 agents would mushroom to 16,000.

The amounts, Bier said, “are so astronomical that they are going to be shoveling money out the door with very little oversight or checks on how it is to be spent. It’s as good as a blank check.”

ICE, with a previous budget of $3.43 billion for detention operations in 2024, would get $45 billion to create a 100,000-bed daily capacity. One potential model was just unveiled in Florida: the instantly notorious “Alligator Alcatraz.” The 5,000-bed tent camp, deep in the Everglades, was slapped together in just eight days. See Bloomberg.

China Housing Crisis

This should serve as a cautionary tale for China, which is confronting real-estate and demographic crises of its own. In recent decades, rapid urbanization, policy-induced artificial land scarcity, the dependence of local governments on land sales for revenue, and heady expectations of future growth caused real-estate prices to soar. Strong demand from first-time homebuyers also helped: since young Chinese typically have no siblings, owing to decades of fertility restrictions, they tend to purchase their first home about 11 years earlier than their Japanese counterparts.

But the number of Chinese urban dwellers aged 28-32 peaked in 2019 – and the real-estate bubble burst shortly thereafter. Now, the real-estate sector – which, at its 2020-21 peak, contributed 25% of total GDP and 38% of government revenue – is blighted by weak demand, falling construction, and severe overcapacity. Declining prices have decimated household wealth, with losses equivalent to China’s annual economic output. This has undermined consumption, employment, borrowing, and investment.

The crisis that is brewing in China is more severe than the one Japan faced. For starters, China’s housing bubble is much larger. For example, residential investment, as a share of GDP, was about 1.5 times higher in China in 2020 than in Japan in 1990. Property accounted for about 70%of Chinese households’ total assets in 2020, compared to around 50% in Japan in 1990. China’s price-to-income ratio today is more than twice that of Japan in 1990.

Moreover, China’s fertility rate is lower. Whereas Japan experienced a second surge of first-time homebuyers a decade after the first, China can look forward to no such thing. The share of the population over the age of 65 is increasing much faster in China than it did in Japan: it took Japan 28 years to get where China will get between now and 2040. During that period (1997-2025), Japanese GDP growth averaged just 0.6% annually.

Finally, China faces much greater deflationary and unemployment pressures than Japan did. Chinese household consumption accounted for only 38% of GDP in 2020, compared to 50% in Japan in 1990.

But perhaps the most ominous portent is that China’s government continues to tout a potential growth rate of 5%, with some prominent figures suggesting that it could achieve rates as high as 8%. To get there, policymakers are pursuing measures with high short-term returns – such as expanding the supply of affordable housing and carrying out quantitative easing – while all but ignoring the economy’s weak fundamentals. As Hegel famously put it, “The only thing we learn from history is that we learn nothing from history.”

Healthcare

Our diets are killing us. David Kessler FDA Commissioner under Bush H and Clinton writes at the Financial Times:

Too many foods are deliberately engineered to contain the potent trifecta of fat, sugar and salt that triggers the brain’s reward circuits in a way similar to nicotine. Both trigger cue-induced wanting, cravings and relapse into bad habits, which in the context of weight means regain.

But the addictive nature of these foods is only part of their harm. For the most part, they contain rapidly absorbable carbohydrates.

Excessive calories and carbohydrates result in elevated insulin levels circulating in our bodies that give rise to increases in liver fat, abnormal blood lipid patterns, type 2 diabetes, and many other chronic diseases.

https://www.ft.com/content/e211bed7-953f-4ec9-9790-d9efef634bfa