July 7

MAGA is a movement of one man, there is no depth to the movement. MAGA is charismatic politics on steroids.

Congressman Mark Green R-Tenn., announced his resignation from Congress on Friday, a move that was expected but shrinks the Republican majority in the House. There will be a special election which the Republicans should win. Still, that will take time.

Treasury Secretary Scott Bessent is WRONG. The BBB Reconciliation bill’s policies toward illegal migrants will lower economic growth and it will NOT lead to increased wages for low skill, low wage Americans. There are already 4 million healthy adult Americans who are not working. These drop outs from society are not going to work in the agricultural fields of the country and they are not suddenly going to learn to wake up and work construction.

Fewer workers means lower economic output.

Bessent’s article for Fox News is nonsense.

https://www.foxnews.com/opinion/president-trumps-big-beautiful-bill-unleash-parallel-prosperity

Trump is pressuring the Federal Reserve to lower rates in order to reduce the funding costs of the deficit. Trump wants 100 basis points, 1%, or more of cuts. But the economy is operating at full capacity. And inflation is slightly above the Fed’s 2% target. The Fed will probably cut rates by 0.25% in September but more aggressive monetary policy is not warranted given the positive economic backdrop.

Aggressive rate cutting policy would cause yields on longer dated Treasuries to rise. The market would fear increased inflation. Trump’s proposed monetary policy would increase rates and increase the federal deficit. The federal deficit is at 1% of GDP. Every one percent increase in rates across the yield curve increases the federal deficit by 1%.

Trump cannot control interest rates and the Federal Reserve cannot control longer term rates. The market is the ultimate umpire of monetary policy.

Trump’s proposed monetary policy would set off an inflation spiral. Rates would rise. Recession risk would increase.

Trump is bonkers about monetary policy. He reminds me of the caudillos of Latin American politics.

For an excellent analysis of Trump’s flawed reasoning, see Greg Ip at the Wall Street Journal.

https://www.wsj.com/economy/central-banking/trump-federal-reserve-fiscal-dominance-1b74cd09

Ip writes: If governments could borrow as much as they wished and set interest rates by fiat, why don’t more do it? Because there is no free lunch. If interest rates are persistently too low, something bad will happen, usually inflation.

Markets and Stocks

The outlook for U.S. equities is positive but caution is warranted as stocks are not cheap. Momentum is strong. New highs are usually followed by new highs. Invest in great companies that will deliver strong returns over many years.

The Atlanta Fed sees Q2 GDP growth at 2.6%.

https://www.atlantafed.org/cqer/research/gdpnow

The St Louis Fed is also at 2.6% GDP growth.

https://fred.stlouisfed.org/series/GDPNOW

And the NY Fed is slightly more cautious. It projects Q2 growth at 1.6.

https://www.newyorkfed.org/research/policy/nowcast/#nowcast/2025:Q2

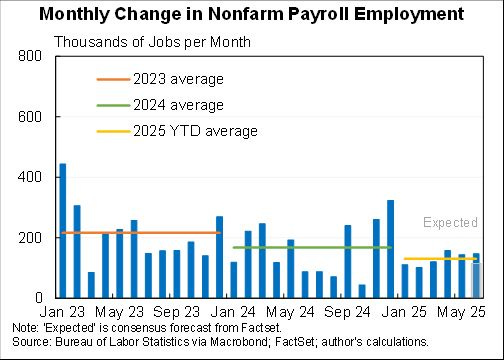

Jason Furman says the economy is an extraordinary employment machine.

The extraordinary U.S. economy continues to be extraordinary. 147K jobs added in June with upward revisions to April and May. Unemployment rate ticks down to 4.1%. Some contrary signs: participation rate down and hours down + weak wage growth. https://x.com/jasonfurman/status/1940757320511697064?s=66

It will be a quiet week for data and earnings. There will be one noteworthy earnings release, Delta. We will get a hint about the state of the consumer.

Economics

The BBB Reconciliation bill’s policies allows more medications to be exempt from Medicare’s price negotiation program, which was created to lower the government’s drug spending. Now, manufacturers will be able to keep those prices higher.

When companies have more money, they invest more in R&D.

Higher prices bring out new life saving drugs.