July 3

The Senate passed the Reconciliation bill. Now the proposed legislation returns to the House.

The Republican Reconciliation bill will become law, and it will cause interest rates to be higher than they otherwise would be and it will slow economic growth over the long term. See below under Economics for WHY.

Don’t chase the sector rotation trade. On July 1, traders sold technology stocks and rotated to other sectors of the market. Institutional money is graded according to short term time horizons, sometimes just a few days. Managing money is extremely difficult and stressful. Long term wealth is built over time as earnings growth compounds and share prices compound as well to reflect higher earnings. Compounding over years is central to building wealth.

Over time the companies which grow earnings faster, generate higher levels of free cash flow and which have higher margins, greater pricing power, outperform. Today, America’s biggest technology companies demonstrate the best financial results. Over time, these stocks will outperform. What matters is stock performance over 1,3, 5 and 20 years, not what happens over a few weeks or months. Invest in superior companies and historical data says you will double your money every 8 years or so. For individuals equities are the best path to creating wealth.

United States inventories of weapons and munitions especially air defense missiles are critically low. The U.S. does not have the military resources to prevent China from conquering Taiwan where over 90% of the world’s most advanced semiconductors are manufactured.

Open wide the immigration door to the best and brightest. See below under Sociology.

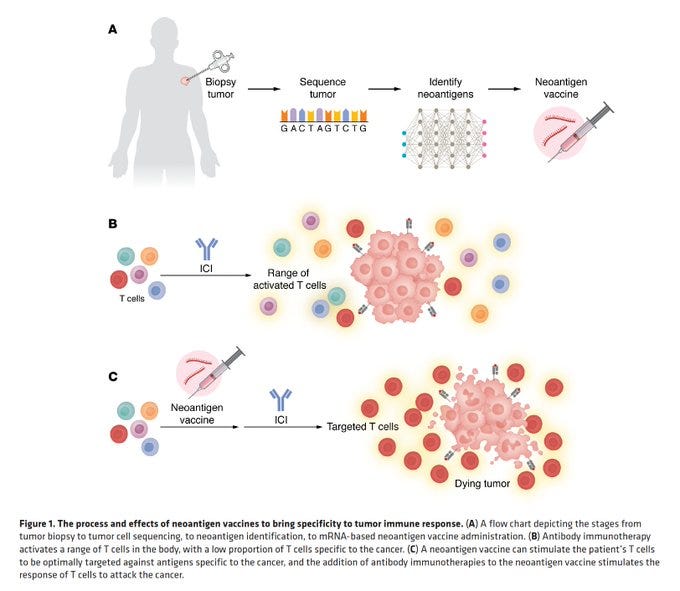

Vaccines are helping to defeat cancer today. See below under Healthcare.

Markets and Stocks

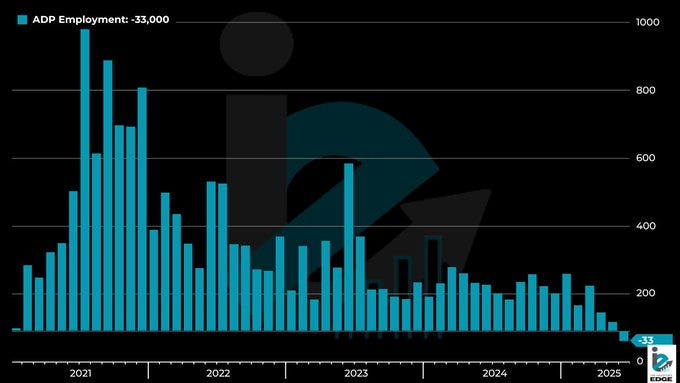

The June ADP jobs report was much weaker than expected.

ADP employment was negative in June and the worst reading since March 2023.

ADP Private Payrolls: -33K vs. 98K est. (29K prior*) https://x.com/cmgventure/status/1940384858792239138?s=66

The ADP report directionally is consistent with the BLS labor report which will be out later this morning. But the specific numbers do not correlate well.

The economy is downshifting. The probability of a rate cut in September is high.

The market is a little expensive. Economic growth is slowing. The Fed will resume cutting rates soon, probably beginning in September. But momentum is positive and I think stocks move higher. Invest don’t trade.

The Wall Street Journal is wrong. China is not rapidly eroding the U.S. advantage in AI. The U.S. enjoys a 5:1 advantage in compute power and an equally large lead in capital deployment. In addition the U.S. has the intangible benefit of capitalism. See Pethokoukis. https://x.com/jamesy54939/status/1940393756584554992?s=66

United States manufacturing remains stuck in the sand of Trump’s tariffs.

New orders in June contracted by the most in three months and have been shrinking for the past five months, likely a reflection of higher tariffs and a general slowdown in the economy. An index of order backlogs fell 2.8 points, the most in a year, to 44.3. Backlogs have contracted a record 33 straight months. See Bloomberg.

I thought that a manufacturing renaissance was a priority of the Administration.

Job openings rose in May to the highest level since November, largely fueled by leisure and hospitality, and layoffs declined, pointing to a stable labor market despite economic uncertainty.

Available positions increased by 374,000 to 7.77 million, according to Bureau of Labor Statistics data published Tuesday. That exceeded all estimates in a Bloomberg survey of economists.

Vacancies in the hospitality sector accounted for three quarters of May openings. The finance, transportation and warehousing industries as well health care also saw more moderate gains. See Bloomberg.

Economics

There are basically three ways that increased debt can make long-term interest rates rise.

First, more government borrowing can increase inflation. People may assume the government will print money in order to help pay off the debt in the future. This can become a self-fulfilling prophecy, where businesses raise prices in order to get ahead of the inflation — thus causing the very inflation they feared. In this case, the Fed will have to hike short-term rates in order to squash inflation, and raising short-term rates causes long-term rates to rise as well.

Second, higher deficits can crowd out private investment. If banks and bond investors have only a limited amount to invest, then higher government debt can starve the private sector of capital, forcing everyone to pay higher interest rates in order to borrow.

Finally, higher deficits can introduce a default risk premiuminto long-term interest rates. Investors may assume that the government’s reckless borrowing is a sign that it doesn’t take its own future solvency seriously. At that point, they may start charging the U.S. government a premium to borrow money. If that happens, private businesses have to pay higher rates too. See Noah Smith.

Politics

The Reconciliation bill will increase the deficit.

The Senate passed its budget reconciliation bill, the One Big Beautiful Bill Act (OBBBA), which would add over $4 trillion to the national debt through 2034 – $1 trillion more than the House-passed bill. The bill also relies on a number of arbitrary expirations; if made permanent, it would add $5.4 trillion to the debt. The Senate also employed a “current policy” gimmick to mask most of its borrowing and avoid the ‘Byrd rule’ against adding to long-term borrowing.

https://www.crfb.org/press-releases/senate-jumps-budget-cliff-reconciliation

Healthcare

EricTopol (@Eric Topol) posted: Yes. The time is now.

Vaccines to treat and prevent cancer.

https://t.co/uJb3xoYvGZ https://x.com/erictopol/status/1940144260155912309?s=66

Sociology

Every single one of the 11 Meta superintelligence hires is an immigrant who did their undergrad abroad.

7 China, 1 India, 1 Australia, 1 UK, 1 South Africa.

8 are PhD or PhD dropouts in the US.

Immigration is key to US AI innovation. https://x.com/deedydas/status/1940081411828121993?s=66