August 27

Markets and Stocks

As Paul Krugman predicted, the July reading for the Fed’s preferred inflation measure, core personal consumption expenditure prices, came in near zero. It was up 0.1%. The core PCE index, which excludes volatile food and energy prices, showed a 4.6% rise year over year.

Economists were expecting 4.8% for the core year-over-year reading and 0.2% for the month-over-month change.

The overall personal consumption expenditure index also was lower than forecast, showing a year over year rise of 6.3% in July, down from 6.8% in June. The index was actually down 0.1% month over month.

Jason Furman described the July income, consumption and inflation report as near perfect.

Inflation is falling fast. The economy is slowing. Consumers are stretched. They are financing spending out of savings. The personal savings rate is low at 5%.

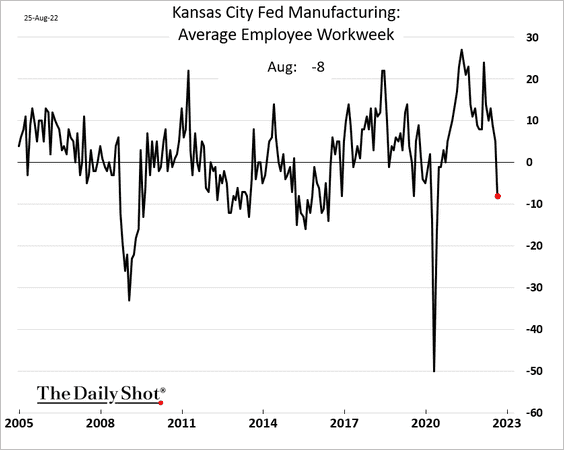

Employers are cutting hours in response to slowing demand.

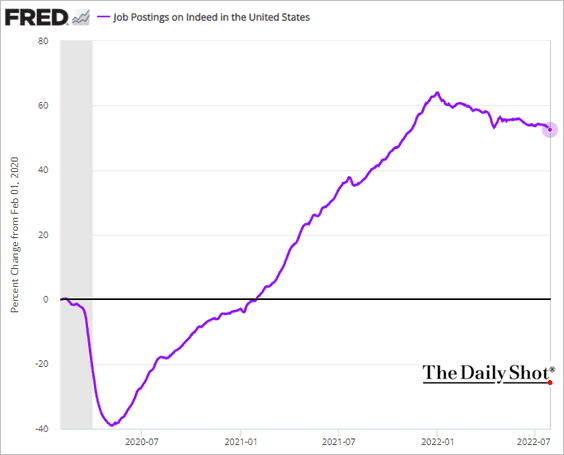

Job postings are rolling over.

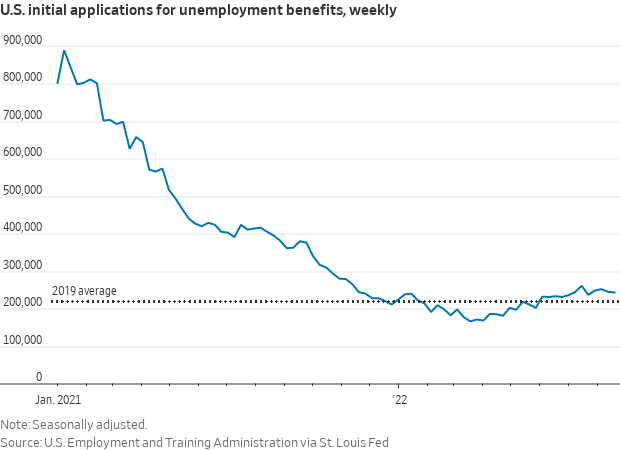

But the economy is not tanking. Jobless claims remain relatively steady.

The weekly number has held close to 250,000 since early July after rising from a 50-year low in March.

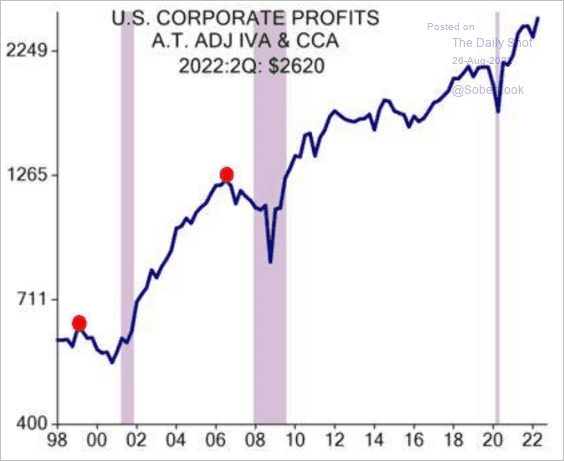

Importantly, corporate profits remain robust. Corporates are in good shape as we head toward a shallow recession.

I like the cyber security company Palo Alto Networks, PANW. The stock is very expensive. It is high risk. But it is a leader in a hot space, cyber security and it is beating expectations. I have a small position in the name.

Economics

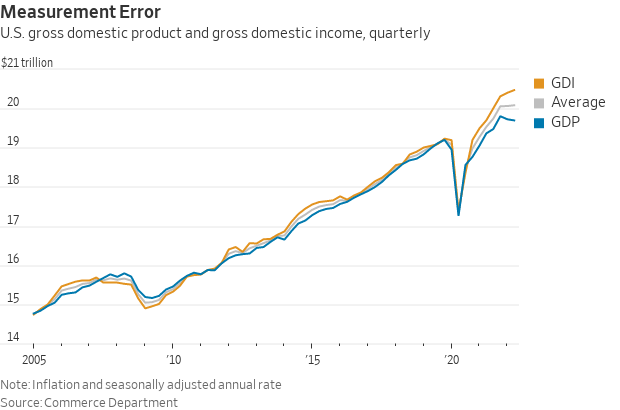

The gap between gross domestic product and gross domestic income is the widest in records going back to 1947. GDP measures the value of goods and services produced in the U.S., GDI measures incomes earned and costs incurred in that production. They're two different ways of calculating economic activity and should be about equal. Instead, one shows the economy growing, the other shrinking. That suggests that the Commerce Department is having a hard time measuring the economy right now, and some pretty significant revisions could be forthcoming.

Having worked in the field of development economics long ago, I remain interested in why some countries strive and succeed, Bangladesh for example, and others do not. The propensity or not to kinship and nepotism is correlated with economic development. Low kinship is associated with economic progress. High kinship bias hinders development.

In a new SSRN paper dated August 25, 2022, researchers led by Duman Bahrami-Rad find that:

Though many theories have been advanced to account for global differences in economic prosperity, little attention has been paid to the oldest and most fundamental of human institutions: kin-based institutions—the set of social norms governing descent, marriage, clan membership, post-marital residence and family organization.

Here, focusing on an anthropologically well established dimension of kinship, we establish a robust and economically significant negative association between the tightness and breadth of kin-based institutions—their kinship intensity—and economic development.

To measure kinship intensity and economic development, we deploy both quantified ethnographic observations on kinship and genotypic measures (which proxy endogamous marriage patterns) with data on satellite nighttime luminosity and regional GDP. Our results are robust to controlling for a suite of geographic and cultural variables and hold across countries, within countries at both the regional and ethnolinguistic levels, and within countries in a spatial regression discontinuity analysis.

Considering potential mechanisms, we discuss evidence consistent with kinship intensity indirectly impacting economic development via its effects on the division of labor, cultural psychology, institutions, and innovation.

High kinship militates against a meritocratic society.

Politics

The President’s policy on student debt relief will be challenged in court. Its lawfulness could hinge on the education secretary’s powers under a 2003 federal statute that gives the head of the Education Department the capability to waive or modify federal student-loan provisions during war or a national emergency.

In legal memos, the Biden administration has argued the statute, the Higher Education Relief Opportunities for Students Act, gives the education secretary sweeping authority to cancel student loans to address financial hardship arising out of the Covid-19 pandemic.

That is a BS argument. The debt relief is all about the mid terms and giving more “goodies” to Black voters, who along with Woke single women form the base of the Democratic Party.

Black student loan borrowers hold the most debt out of any other racial group. An April report by PBS News Hour found that, among 2016 graduates, nearly 40 percent of Black students graduated college with $30,000 or more in debt compared to only 29 percent of white students, 23 percent of Hispanic students and 18 percent of Asian students.

Equally important, only 42 percent of Black college students actually graduate within six years. That contrasts with the White graduation rate of 62 percent.

A college degree usually pays for itself. College graduates earn more; consequently, they have the financial means to pay off their student loan debts. But student debt is a problem for college quitters. Should society be on the hook for men and women who just give up ?

Sociology

Deservedly, Professor Raj Chetty and his fellow researchers deserve accolades for their ground breaking work on “inter connectedness.” When children from lower income households have friends from higher income households, the lower income children benefit. They are more likely to achieve later life success. But Chetty and his team ignored one connection related to “inner connectedness,” family.

There is one neighborhood characteristic that actually rivals economic connectedness in explaining upward mobility, however: family structure. In the first paper’s univariate analysis, the proportion of single-parent households has a more powerful (negative) correlation with upward mobility in their analysis of zip code data than EC has a positive. (The multivariate analysis of zip code data suggests that family structure is about as predictive as economic connectedness). You can find this information in several charts included in the first paper and in supplementary figures associated with it, yet Chetty and his team mention family structure only in passing in the discussion. Media coverage followed his lead.

What makes this oversight—if that’s what it is—especially striking is that family structure, as a powerful variable in strengthening neighborhoods and children’s upward mobility, has popped up in a previous Chetty paper, where it was once again largely avoided. His 2018 study, “Race and Economic Opportunity in the United States,” found that adult employment rates are higher and school suspension rates are lower when black boys grow up in “areas with higher black father presence,” even if their own father is not living with them. An executive summary of the paper concludes that “what matters is not parental marital status itself, but rather community-level factors associated with the presence of fathers, such as role-model effects or changes in social norms.” But in the large majority of cases where a father lives with the child—i.e., “father presence”—the parents are married. As Brad Wilcox wrote in a detailed take-down in these pages, the fact that most married-couple households have two workers distorts the paper’s findings on adult household income. In any case, if the share of two-parent households has a significant positive effect on neighborhoods’ social environment and upward mobility in 2018, you’d think it would be worth at least a nod, and hopefully more than that, when it shows up in 2022. It might even be that neighborhood family make-up has some positive correlation with economic connectedness.

Family matters. Eighty percent of the men in prison do not know their fathers. Men who grow up without a positive role model are four or more times more likely to be incarcerated.

It drives me crazy. Why can’t our policy elites focus on what matters, family structure, not more welfare or universal basic income?