October 26

Kamala Harris and Donald J. Trump are locked in a dead heat for the popular vote, 48 percent to 48 percent, according to the final national poll by The New York Times and Siena College

I don’t like Trump. I don’t like Harris either. But can someone who is fearful of Trump tell me how if elected president he could act as a fascist dictator.

The left is running scared and talk of fascism and dictatorship is so much BS.

If Republicans run the table, Democrats will genuflect before the Supreme Court and the filibuster rule in the Senate.

Democrats are the party that wants to rewrite the Constitution to create a parliamentary system of government, where Congress is effectively unbounded by any legal or constitutional restraints.

I bet Democrats are privately thinking: thank goodness for the Constitution.

The Washington Post notes that Vice President Kamala Harris’s closing argument is that former president Donald Trump is “unhinged,” even saying Wednesday that she believes he is a fascist. But polls regularly find that a sizable share of voters think Trump would be good for democracy, even better than Harris.

Among the latest poll to find this is a Washington Post-Schar School survey of voters in seven swing states. Threats to democracy rank high as an issue to registered voters, and slightly more trust Trump to handle them than Harris.

Markets and Stocks

For the S&P 500 to make a run at 6,000, the yield on the 10 year Treasury must fall toward 4%. As I write, the yield is trending around 4.2%.

Monetary policy is very restrictive and financial conditions have tightened over the past 6 weeks or so; consequently, the economy should slow but not signal recession.

I am very excited about CME Group, CME. It is a play on transaction volume in financial markets, hedging activity and the creation of new financial products. I have been following the company for 20 plus years.

CME posted Wednesday Q3 earnings that rose past the average analyst estimate as the derivatives exchange recorded fresh "records across volume, revenue, adjusted operating income, adjusted net income and adjusted earnings per share," said Chairman and CEO Terry Duffy.

"Q3 2024 was the best quarter in CME Group history," he said.

Q3 adjusted EPS of $2.68, topping the $2.53 consensus, rose from $2.56 in Q2 and $2.25 in Q3 2023.

Revenue of $1.58B, slightly trailing the $1.59B expected, climbed from $1.53B in the prior quarter and $1.34B a year before.

Clearing and transaction fees accelerated to $1.30B from $1.25B in Q2 and $1.09B in the year-earlier period.

Market data and information services revenue was $178.2M, up from $175.0M in Q2 and $167.6M in Q3 of 2023.

Average daily volume was a record 28.3M contracts, including non-U.S. ADV, with EMEA up 30% and Asia up 28% from the same period a year ago.

In great news for the country, wafer yields at the new TSMC fabrication facility in Arizona are running about 4% above yields in Taiwan.

If sustained, then the Arizona fab will demonstrate that the U.S. can compete in fabs.

Honeywell is a great investment at current prices. It is also a vault stock.

HON has a 33% Return on Equity which is fantastic.

Honeywell International Inc.'s (HON) return on equity (ROE) is calculated by dividing its net income by its shareholders' equity.

A ROE of 15% to 20% is generally considered good, while a ratio of 5% is considered low.

Honeywell operates in four main areas of business: Aerospace, Building automation, Performance materials and technologies (PMT), and Safety and productivity solutions (SPS).

HON should earn around $11.50 in 2025. Given its margins, high returns and end markets, I believe that the company can sell with a low 20s multiple. My 12 month target is $250. The stock is currently trading at $209. I see 20% upside over the next 12 months.

https://www.nasdaq.com/market-activity/stocks/hon/earnings

Though it is expensive, I like Eli Lilly. Barron’s reports:

A new study adds evidence to the theory that Novo Nordisk’s Ozempic may help prevent Alzheimer’s disease. That could mean that Novo shares, which have more than doubled over the past two years, remain dramatically undervalued.

https://www.barrons.com/articles/nvidia-stock-price-big-tech-earnings-909f67d3

Economics

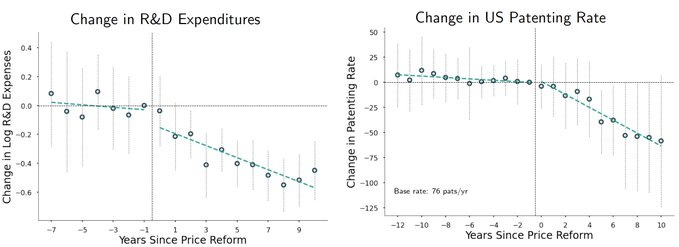

@parker_rog Government price controls reduce R&D and consequently healthcare innovation.

Less revenue meant less money for innovation:

53% less R&D spending

75% fewer U.S. patents

25% decline in FDA device submissions

49% fewer new firms entering the market

https://x.com/parker_rog/status/1849145174355513458?s=66&t=hi3LjJ8kVbN50WgSIEfnAg

Greg Ip, senior journalist at the Wall Street Journal writes about the IMF and free trade.

Eighty years ago world leaders meeting in Bretton Woods, N.H., created the International Monetary Fund to prevent the sorts of economic imbalances that had brought on the Great Depression.

Today, imbalances once again threaten global harmony. China’s massive trade surplus is fueling a backlash. The U.S. attributes those surpluses to China holding down consumption while subsidizing manufacturing and exports, inflicting collateral damage on its trading partners. And it would like the IMF to say so.

The IMF, though, has steered a more neutral path. It has prodded Beijing to change its economic model while playing down any harm from that model for the world.

Decades ago, U.S. leaders thought bringing China into the postwar economic institutions such as the IMF and World Trade Organization would make Beijing more market-oriented and the world more stable. They now think the opposite. China has doubled down on an authoritarian, state-driven economic model that many in the West see as incompatible with their own.

The IMF, the world’s most influential international economic institution, may find itself torn between irreconcilable visions of the global economy, especially if former President Donald Trump is re-elected next month.

Trump has prioritized reducing the trade deficit, especially with China, through tariffs, an approach the IMF has criticized. Many of his advisers are deeply suspicious of both Beijing and international institutions.

https://www.wsj.com/economy/global/the-u-s-and-imf-disagree-about-china-thats-a-problem-7ab5fca8

China is an enemy of the United States. China poses the greatest threat to the nation state and our liberty since the rise of Hitler.

U.S. policy should be designed to deter, to contain and weaken China.

Politics

Government regulations make it difficult to do anything.

The average large solar project is delayed 5-10 years by bureaucracy. Part of the problem is NEPA, the infamous environmental protection law saying that anyone can sue any project for any reason if they object on environmental grounds. If a fossil fuel company worries about a competition from solar, they can sue upcoming solar plants on the grounds that some ants might get crushed beneath the solar panels; even in the best-case where the solar company fights and wins, they’ve suffered years of delay and lost millions of dollars. Meanwhile, fossil fuel companies have it easier; they’ve had good lobbyists for decades, and accrued a nice collection of formal and informal NEPA exemptions.

Even if a solar project survives court challenges, it has to get connected to the grid. This poses its own layer of bureaucracy and potential pitfalls. See Marginal Revolution.

On the controversy regarding Elon Musk and Putin, the DealBook of the New York Times says:

Elon Musk has ramped up his campaign to get Donald Trump elected in recent weeks, rallying hard in the battleground state of Pennsylvania, and controversially offering $1 million to registered voters who back one of his pet conservative political initiatives.

Now, a new report on his apparent ties to President Vladimir Putin of Russia has renewed questions about his relationships with the U.S. government and with Trump, and what role — if any — Musk should play in politics.

The Tesla C.E.O. has been in regular contact with Putin since late 2022,according to The Wall Street Journal. Their conversations have been wide-ranging, touching on personal issues, business and geopolitics. On one occasion, the Russian president asked Musk not to activate his Starlink satellite service over Taiwan to help China’s leader, Xi Jinping, The Journal reports.

That’s turned the spotlight back on Musk’s lucrative links with the U.S. government. Last year, his companies counted almost 100 contracts with 17 federal agencies, promising to pay out $3 billion, The Times reported. SpaceX, his rocket company, essentially controls NASA’s rocket launch schedule — that was in full view again with another successful mission this morning — and the Defense Department uses it to get most of its satellites into space. Starlink services are used by U.S. embassies and government departments, like the U.S. Forest Service.

Trump has said Musk could play a role in his administration. Just this week, Musk said he would push to change regulations on self-driving cars — a big imperative for Tesla — if he is put in charge of a government efficiency agency.

Is the story accurate? We all recall the Steele Dossier of the 2016 campaign which was a political dirty trick by Hillary Clinton. Alternatively, is the source of the story, an intentional leak by the Biden Administration which would like to destroy Musk ?

Time will tell. My view is that Putin is an enemy of the United States and must be stopped in Ukraine. If Trump wins however; he will try to force Ukraine to surrender. That scenario would harm the United States. Putin wants to recreate the Soviet Union. Trump is generally right on China, and just plain wrong on Russia.